Quisitive Technology Solutions

LedgerPay: Unleashing the Power of Microsoft and Blockchain Technology

Hey Folks,

Been a while since I got anything up for you guys and I have been burning to write on Quis. So lets get at er.

I first came across Quisitive last April when I was in the deep end of the Internet looking for companies that were pennies now that could be many dollars years from now. Quis caught my eye for a couple reasons

They help companies onboard to the cloud and subsequently assist them in leveraging the opportunities that come from the information/data gathered. I thought about Covid-19 and how it would likely accelerate the adoption of companies utilizing technology like this.

They had made the short list of being a preferred Microsoft Solutions Provider, had a Stacked leadership team, some of which were Ex-Microsoft Management, and traded at .40 cents Canadian.

LedgerPay

Quis is one of the first companies I bought. I averaged up to .68 cents from April 2020 to August 2020. I have listened to each earnings call since owning shares and the CEO Mike Reinhart always delivers a smooth, confident presentation, which over the last two quarters has been all about the Launch and Scaling of LedgerPay. More on that later.

I felt I could have inputted more financial analysis in my Bragg post so I’m going to start right here with going through Quis’s 2020 numbers as reported so far, (Canadian Small Caps get way to effin long to report FYE if you ask me). Were gonna see Q4 FYE 2020 sometime in April). I’m bullish on Quis but want to present a fair piece here and we’ll see where this stack goes.

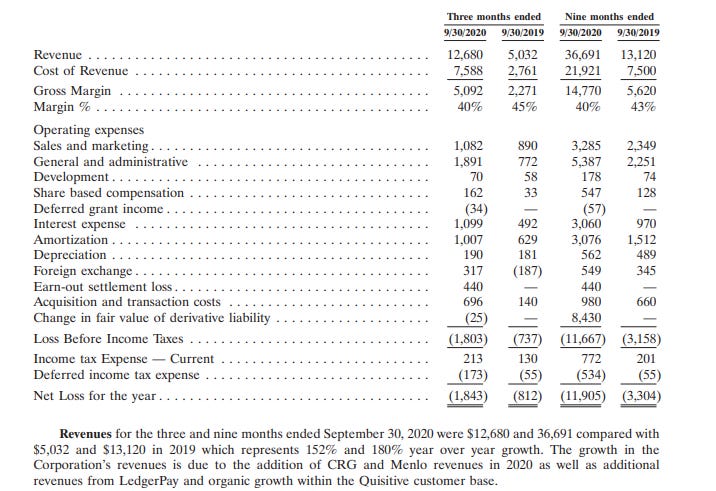

Prima Facie that Revenue growth looks great, but it’s currently cutting into GM. Quis acquired two businesses (Corporate Renaissance Group and Menlo) through 2019 + Q1 of 2020. They took on Debt to acquire these companies and its tripled their interest expense through 3Q’s of 2020. Amortization of Intangible assets has doubled with the acquisitions of the the aforementioned companies. General and Admin goes up over a twofold amount due to among some other things, the increase in employees on Quisitive’s books. The Earnout Settlement is paid to CRG. Here is some more financial information from the Earnings Report:

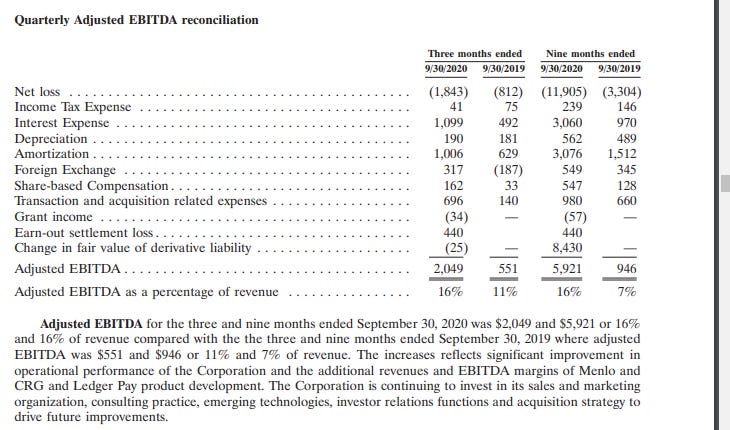

Their adjusted EBITDA is improving, they are working towards profitability as shown below:

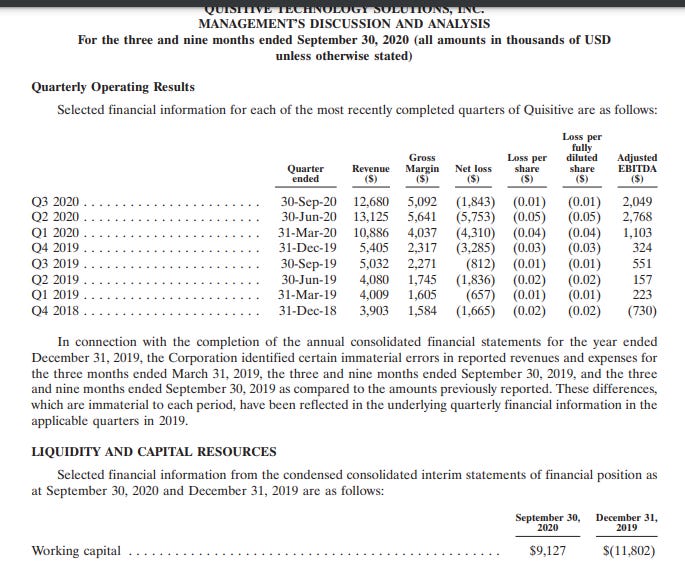

Q3 having lower rev than Q2 was questioned on the earnings call so I can provide some colour here: Mike Reinhard said that Many employees used vacation time that had not been used in the prior quarter (Q2) due to the lockdown in most of the world, and he noted that their customer’s also experience a similar trend with employees taking time off. It was nothing of concern to him, something that had to happen as employees earn this time off and need to use it. Projects were pushed into Q4, it was not a result of less business, simply not recognizing the revenue until the projects were completed.

Getting back to the Acquisitions, I’ll take a some time here to provide a brief description on what the companies acquired did (on their own) /do (now for quis).

The first to close was CRG in Q2 of 2019. CRG was also an award-winning Microsoft Partner operating near Ottawa, ON. At their core they offered consulting services utilizing Microsoft solutions and had an enterprise-class performance management software called emPerform that is SaaS revenue. They had generated $7.8 Mil in rev in 2018, 30% of which was recurring, with an adjusted EBITDA % at 38.5 for nearly $3 million dollars. This acquisition helped add depth to Quisitive’s offerings for potential customers, expanded its reach across Canada, the US and Caribbean and brought along with it some sticky rev.

The Menlo Acquisition closed on Jan 1 2020. Menlo operates on-shore in Menlo Park California and off-shore with a development team in India. Menlo offers Microsoft Dynamics services as well and in particular specializes in cloud development, data analytics, mobile technology and enterprise business application services. Acquiring them allowed Quisitive to reach larger enterprise customers. Trailing 12 month rev as of Sept 2019 was $17.5mil USD, with EBITDA of approx $2.4. Tells you how important recurring revenue is.. CRG’s 30% pretty much drops to the bottom line.

Quisitive’s goal is to be the Preferred Microsoft Partner in North America, these acquisitions have thus far allowed it to continue getting closer to that. On Nov 23rd, 2020, the company joined the Microsoft Cloud Native Accelerate Program which allowed Quisitive to further leverage Microsoft’s technology and expertise in the cloud space along with forming more working partnerships between the companies. At this point in time Microsoft brings business to Quisitive.

Let’s turn things up here a notch and introduce LedgerPay.

LedgerPay is an innovative payments intelligence platform and data insights solution that can transform the data from a debit or credit card purchase into useful and actionable information for the merchant. The value for the Merchant is to be able to use this data in such a way to provide unique and targeted offerings to its customers that would put it in a position to realize more engagement ($$) from its customer base. Now I’m not the most technical motherfucker in the world and LedgerPay is a proprietary blockchain technology and the only one leveraging the Microsoft Azure Cloud so I fail here in being able to break this down farther. I’m gonna put ye olde copy and paste to work here and offer up this video as a means to understand what it is exactly that LedgerPay can do.

<iframe title="vimeo-player" src="

width="640" height="360" frameborder="0" allowfullscreen></iframe>

I hope that provided some colour and helped breakdown the value proposition for using LedgerPay. Quisitive is on the brink of launching this program. Lets go back to January and Set the Table:

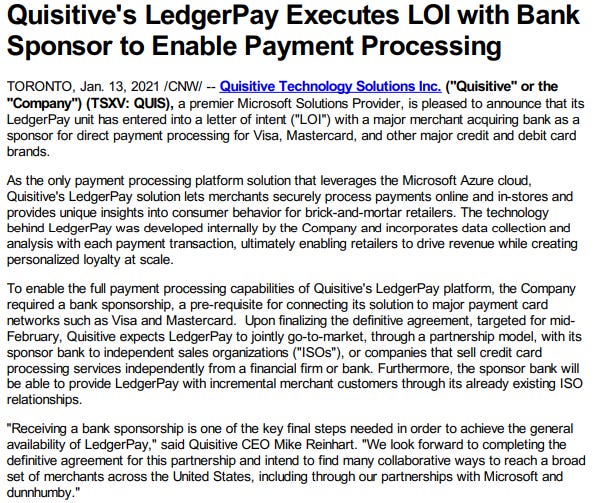

This is the first Domino to Fall in making the Launch of LedgerPay occur at scale. The company has been testing it in partnership with Dunnhumby in beta and with smaller merchants thus far. And we are expected to see revenue on the books for Q4 from LedgerPay. The bank sponsorship is key, it will allow LedgerPay’s technology to be applied to Visa, Mastercard and other CC’s and debit card brands.

Note how it says to have finalized the deal by a target date of Mid-Feb.. Now lets look at Quis from a technical perspective and I’ll provide some commentary.

Look at that run Quis went on Through the first half of Feb. Now, granted I will recognize this was the last push up in the markets before we really sold off and I know a lot of things were running. But damn, 11 bull candles in a row. Note volume wasn’t anything to write home about. That’s Where On Balance Volume, i.e., Smart Money can help explain this. The market at large is still sleeping on Quis, but these large funds know what is coming here, they know that this product launching in the US is going to be visible because of Quis’s relationship with Microsoft. They want to be in before retail starts sending this flying. We didn’t get the anticipated announcement of a Definitive Agreement from a sponsoring bank as Quis led us to believe. But we did get a telling hire to the leadership team for LedgerPay, shared below: (also note my blue arrow above on the early march bull candle on good volume, I’m going to get to that in a second).

I’ll try to provide some context to this partnership from some details shared on the Q3 conference call. Quisitive wants to scale LedgerPay fast, I mean real fast. Mike Reinhart alluded to the company seeking acquisition in the payments solutions providers space where they could shift out the tech these companies were using for their customers and plug in LedgerPay and start bringing in revenues from such implementation. Adrian Martinez will likely be part of shortlisting the merchants Quis looks to acquire in terms of scalability and profitability. Need to make the acquisitions count. Quis had about $7.5 mil in cash on Hand (working capital shown above is north of $9mil) at the end of Q3 (taken from SEDAR filings). That’s not a crazy amount…

I note that march candle with a blue arrow for the following reason, Its a big one.

Microsoft took the initiative to be a part of the LedgerPay launch.. They have been watching and working with Quis and know they have something here. You want to talk about scaling at large… MR notes that it will significantly augment their sales efforts as they go joint to market upon announcing the Bank Sponsorship. But that Damn cash position man. Quis cannot take on more debt as already highlighted at the beginning of this piece they are quite leveraged. Welcome in FAX Capital:

Now this is not to be confused with a bought deal, these shares are from treasury- coming from the company (already existing) the similarity it does share with a bought deal is that they are given at a discount to the market price, but the key difference is it isn’t dilution. These shares were already part of the float. FAX Capital literally exists to invest in companies with high-growth potential and aim to realize capital appreciation in its own shares by way of owning other business’s set to experience rapid growth in business and share price. These guys ponied up $20 million for Quis to go out hunting for top quality merchants to acquire. They will own 7.6% of Quis and those shares are locked up for a year.

Upon the closing of the deal Quis will have nearly $30 mil cash (without adding any + cashflow from ops in Q4). This certainly places them in a better spot to achieve their goals of scaling LedgerPay quickly.

I own Quis for the potential of LedgerPay. Quis of course is solid business on its own, but LedgerPay, I believe, will provide the company to really enter in stage of very strong growth with rev high-margin Revenue leading that growth. Its partnership with Microsoft can not be overlooked. Quisitive was named a TSX-V top 50 company for 2021 and I wouldn’t be surprised to see an uplisting to the big board in Toronto in Q2 and whispers of a US Uplisting from the OTCQB in the US by year end to help increase its liquidity.

The stock I believe is going to present a buy-point here this week

I see some similarities in the run ups here, Black bull candles indicating a close that was lower than the open but higher than the prior days close, with a high tail near the top and a solid bear candle following. I am not expecting the LedgerPay Bank DA to be announced tmrw, so we could see a pull back and a bear candle with a tail that slices through the 20 day EMA. I am preparing a limit buy for $1.40 tmrw making Quis an overweight position in my Portfolio. I have the benefit of $0 commission trades on WealthSimple so my first limit wont be my largest buy. $1.40 will alert me to the slice, and then ill watch and add accordingly on weakness underneath the 20day EMA. I am not a pro trader or Technical Analyst so I could be off here and I encourage you to form your own opinion of where the stock price may go.

I hope You all enjoyed this piece on Quisitive. Its CDN ticker is $QUIS.V and its Foreign ticker is $QUISF

Disclosure O’clock: as noted in the stack I own shares of quis, I am bullish on quis. This is not an exhaustive examination of the company and thus anyone looking to buy quisitive should do their own DD before purchasing shares. I am not being paid for this stack, I prepared this piece on my own using the company’s News Releases and Financial filings on SEDAR.

Thank you for Reading,

Luke